Risks and rewards are generally shared proportionately to ownership. Sole proprietorships can be owned by more than one person.

Res 341 Week 3 Statistical Symbols And Definitions Matching Assignment 30 Off Statistical Chi Square Null Hypothesis

Which of the following best describes a sole proprietorship.

. Sole proprietorships are the most common form of business organization in the United States. C A consulting firm called AAA Engineering Incorporated. Which best describes the difference between sole proprietorships and partnership.

Two or more people carrying on an unincorporated business. For this option there is no legal distinction between the business and the owner. A sole proprietor cannot be dissolved or sold to another person.

A man who owns and operates a lawn mower repair business by himself. Note that unlike the partnerships or corporations. There is no distinction or separation between a sole proprietor and his or her business.

The main difference between the two is the number of owners. C The sole proprietor owns all of the business and has the right to receive all of the businesss profits. Sole proprietorships and partnerships are common business entities that are simple for owners to form and maintain.

Which one of the following best describes the primary advantage of being a limited partner rather than a general partner. MCQs on Sole Proprietorship. It is the preferred form of business ownership because of its simplicity O b.

The sole proprietor of a business is protected from liability for debts of the business if the assets of the business are kept separate from personal assets O c. On Edge Advertisement Survey Did this page answer your question. Sole refers to one or more owners whereas sole proprietorship means that one person owns the company.

B A man who owns and operates a lawn mower repair business by himself. Sole proprietorships do not have to pay employment taxes. Separation of ownership and management.

Which best describes a sole proprietorship. The attribute that best describes sole proprietorship is - Answer - Unlimited liability for the owner Explanation - In sole proprietorship the own. The owner could lose personal property if.

Sole Proprietorship is a business that is formed or created by one person. In other words the business is one and the same as the owner. Having a sole proprietorship is the most straightforward way to start or end a business because government regulations do not apply.

What Are Three Key Differences Between Sole Proprietorships And Partnerships. A sole proprietorship has one owner while a partnership has two or more owners. A A business in which only one partner is fully liable for the business debts b A business with a single owner who is responsible for all debts but individually controls all profits.

It refers to a business owner. A sole proprietorship is a business owned by the individual not the business. A sole proprietorship is a firm owned by a single person who has the complete responsibility to bea View the full answer Previous questionNext question COMPANY About Chegg Chegg For Good College Marketing Corporate Development Investor Relations Jobs Join Our Affiliate Program Media Center.

Sole proprietorships generate about 40 percent of all sales in the United States. B The owner has the right to make all management decisions concerning the business including those involving hiring and firing employees. It makes it difficult for the owner attract good employees.

The sole proprietorship is the simplest business form under which one can operate a business. Which of the following describes a sole proprietorship. Members or officers carrying on a business that is a separate legal entity.

Sole proprietorship has a single owner while partnerships has two or more owners. Sole proprietorships-also called sole traders or proprietorships-are unincorporated businesses that are owned by one person and that are subject to personal income tax. D A criminal law firm with multiple senior partners.

Sole Proprietorship A sole proprietorship is a type of business entity that is owned and run by one individual and in which there is no legal distinction between the owner and the business. The sole proprietorship is not a. A sole proprietorship is difficult to create The profits of a sole proprietorship are taxed twice.

There is no legal distinction between the individual and the business every asset belongs to the owner. An individual owning and running a business. A business owned by an individual Which advantage of a sole proprietorship could also be a disadvantage.

A business owned by an individual partnership a business owned by two partners How does a lack of financial resources for fringe benefits affect a sole proprietors ability to run a business. A Forming a sole proprietorship is easy and does not cost a lot. View the full answer.

The benefits of Sole Proprietorship includes. It is the simplest legal form of a business entity. As opposed to this a partnership can be formed by having at least two owners.

The sole proprietorship is the most common form of legal structure for small businesses. Advertisement Answer 50 5 22 desiedgoddess Sole proprietors keep all profits and have unlimited liability while partners split profits and share liabilities. A sole proprietorship also known as individual entrepreneurship sole trader or simply proprietorship is a type of an unincorporated entity that is owned by one individual only.

Identify Which statement about sole proprietorships is true. Simply put its as simple as that. The sole proprietorship is the simplest kind of business to operate.

The limited partner has greater management responsibility The limited partner is entitled to a larger portion of the. Which best describes a sole proprietorship. Income and losses are taxed on the individuals personal income tax return.

The sole proprietor has complete control over his business as well as the decision making process of the business b. An individual owning and running a business. Lastly a partnership is a joining of individuals in which the partners share profits or losses.

A business with a single owner who is responsible for all debts but individually controls all profits. A sole proprietorship is a type of business entity thats run and owned by a single person. A business that legally has no separate existence from its owner.

Question 8 1 pts Which of the attributes best describe a sole a proprietorship. Agents operating businesses independently of each other. What are the main differences.

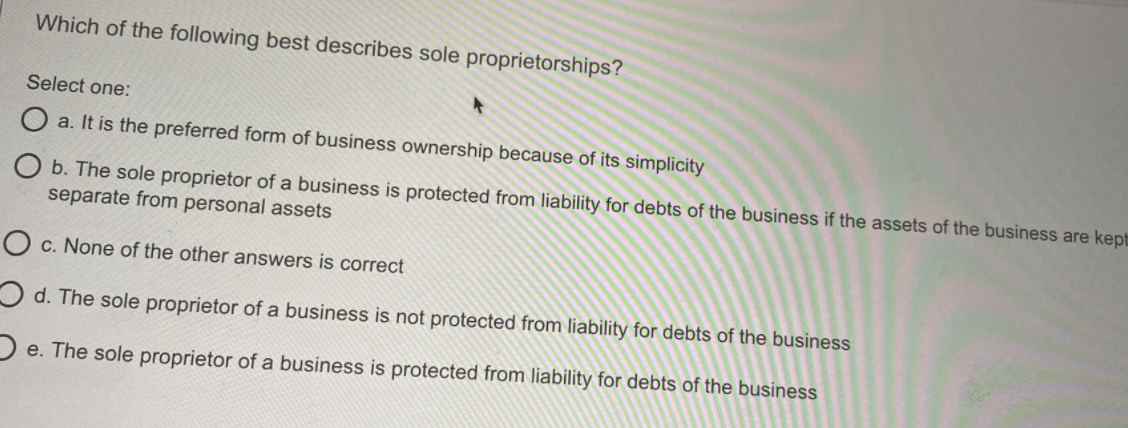

A sole proprietor has full control Why is liability disadvantage of sole proprietorship. Not at all Slightly Kinda Very much. Which of the following best describes sole proprietorships.

Fin 370 Final Exam 54 Questions With Answers The New Exam 1st Set Buy This One 30 Off Exam Final Exams Finals

Solved Which Of The Following Best Describes Sole Chegg Com

Bus 210 Week 2 Knowledge Check Limited Liability Company Knowledge Liability

0 Comments